Best Investment Ideas For Small Investors unearths the great stocks, low on the radar with Huge Potential.

See, there are ample stocks in the stock market. Due to that reason, investment ideas have no clarity.

What investments give the best return is what a small investor looks for.

We’ve to always look for long-term investing along with short-term trading gains.

If short-term options trading is what you are interested in, you are probably looking for an options trading course.

With investing, you are making long-term gains. Because of this, your tax is saved as long-term gains are non-taxable.

Let me give you some investments that are long-term with great gain potential.

See trading and long-term investing should go hand in hand. The reason for this is, your current income should get compounded for long-term gains.

Your long-term investment makes your money work for you.

When you invest your time for money, your growth is capped. But instead, when you make money make money, you are in double profits.

Great gains are the result of the best investments you make now.

In this article, I’ll give you direct small-cap stock ideas for investment with a fixed target.

This article will include lots of golden nuggets of trading to give you the best investment ideas for small investors.

Without further ado, let’s jump into, best ideas for small investments.

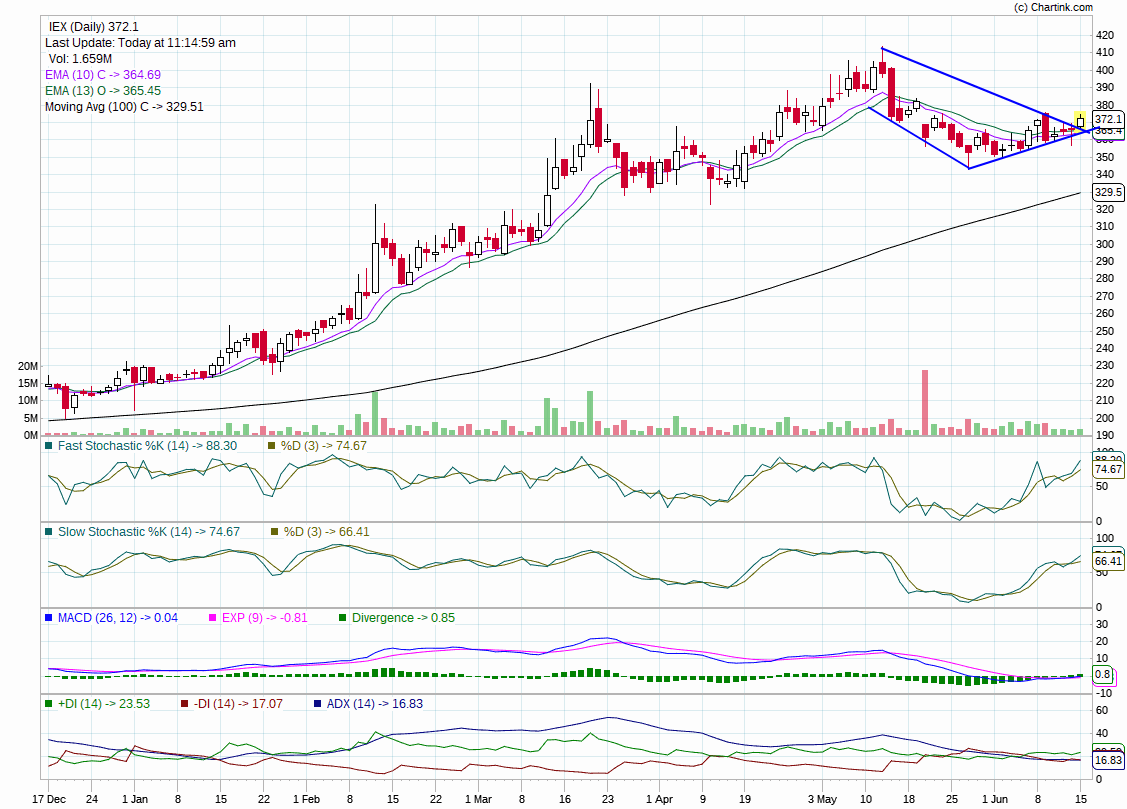

1) Indian Energy Exchange (IEX)

This is one of the best investment ideas for small investors in stock markets now.

Strong Technical Analysis Data of Indian Energy Exchange:

- Indian Energy Exchange is just coming out of a rounding bottom formation as shown in the chart. This means a strong up move is in the making of the chart.

- The trend from the levels of 200 is continuously Up. This results in showcasing, a continuation of the trend.

- The stock has formed a declining resistance path and just broke out of it. This means the stock has very strong upside potential.

- Fast Stochastic is at 88. Because of this, an up move potential has unlocked.

- Slow Stochastic is at 74 levels. Because of this, a possibility of a great uptrending move is in happening.

- MACD is higher than the signal. As a result of this, Uptrend is shouting high in the market.

- MACD is at +0.04. Because of this, the momentum in the stock is higher and the stock will move higher.

- 100 Day Simple Moving Average is never touched. As a result of this, a very strong uptrend continuation is created.

- Indian Energy Exchange broke its declining resistance pattern. Because of this, the stock’s upside is more confirmed.

These points above denote that Indian Energy Exchange is having a huge potential to move Higher.

CMP: 372.1

1 Year Target: 442

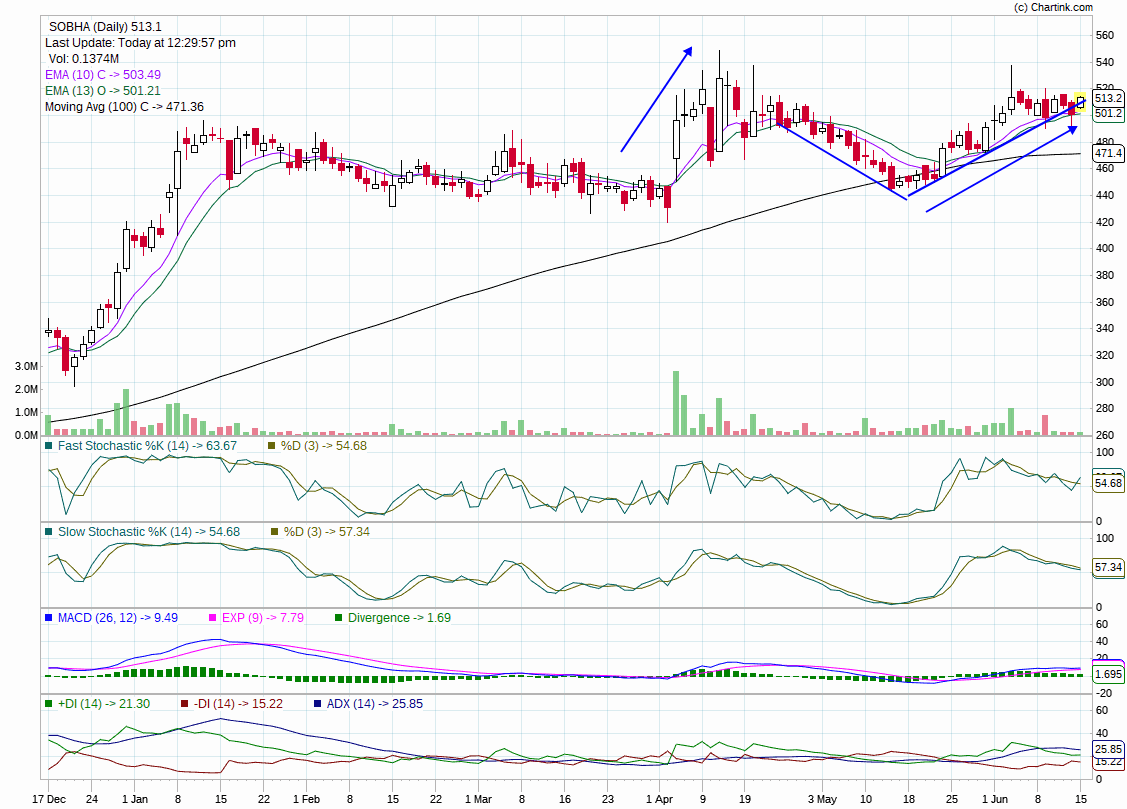

2) Sobha Limited (SOBHA)

One of my favorites in the space of small-cap investing.

Disclaimer: SOBHA is a part of my portfolio since it was 202 added in October 2020.

I am very much looking at making my money grow for me with the best investment that gives good returns.

Your money has to grow well, with less work. As a result of this, your passive income builds over time and you can make money without trading your time.

Sobha Developers is my favorite pick of all time.

I follow a principle that Mr. Warren Buffet quotes.

Be Bullish when everyone are bearish. Be Bearish when everyone are Bullish

When the whole trading fraternity was bearish, I was investing for the long term.

That’s when I picked Sobha Developers. As a result of this, it has doubled in less than a year.

But I’m more bullish on this stock than others are, due to technical analysis reasons.

Technical Analysis of Sobha Developers:

- 10 Day Close EMA is above 13 Day EMA. Because of this, there is a more bullish trend.

- Sobha came out of the rounding bottom formation. As a result of this, we see huge upside potential.

- I see 100 Day SMA is hugely positive for the stock and showcases strong support.

- Since stock is taking good support at 13 days EMA, we see a good gain potential.

- Fast Stochastic is at 63. Because of this, the stock’s uptrend potential is huge.

- Slow Stochastic is at 54 denoting a huge uptick.

- MACD is at 9.49, above signal. As a result of this, we see a huge momentum for Sobha to GO UP.

- The recent down in Sobha was because of its huge gains in a single day of 13%. Because of this, the momentum has not dried out in the stock.

Looking at all the above technical analysis my target is as below.

CMP: 513.2

The target for the Next 1 Year in SOBHA is: 588

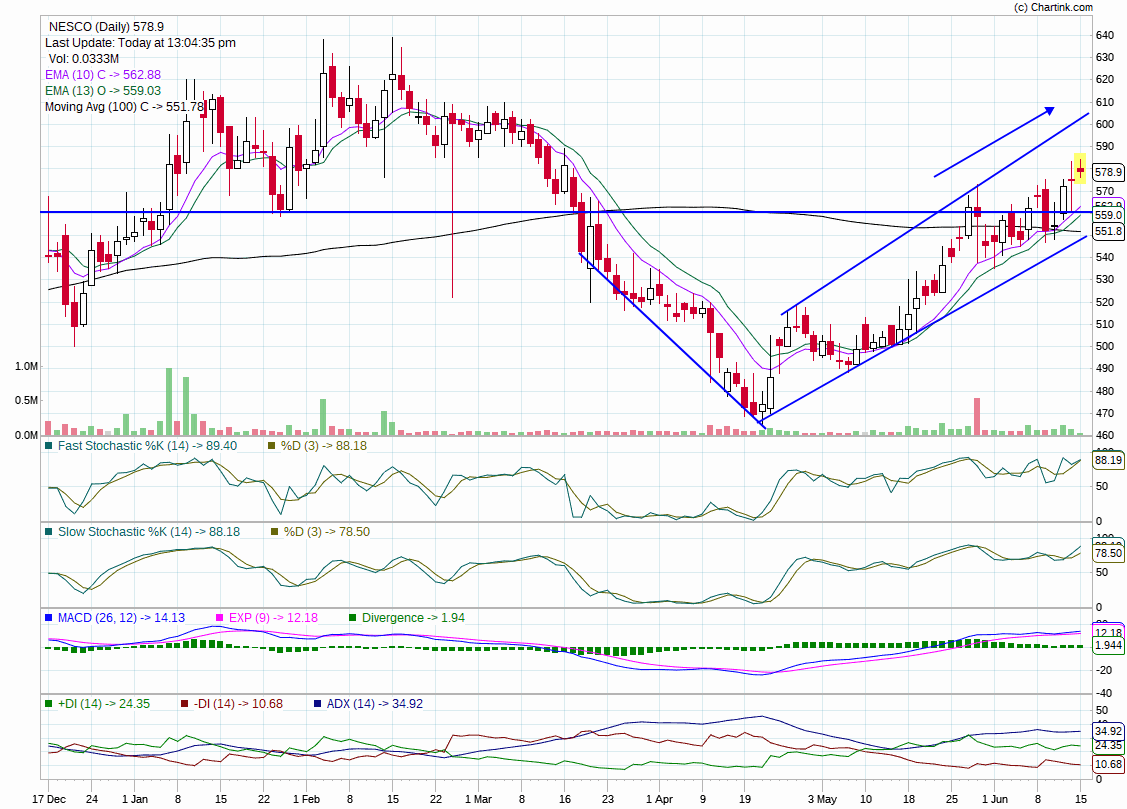

3) NESCO Limited (NESCO)

Nesco has a very huge potential to grow wrt. technical analysis terms. Because of this, its been on my watchlist for some time now.

Now that it has broken its crucial resistance at 559, it’s high time that we look at a great stock to make money investing.

I’ll give you great things in technical analysis, which gives an added advantage to NESCO for investing.

Technical Analysis of Nesco Limited that Denoted a BUY:

- Nesco came out of a rounding bottom formation. Because of this stock is in a clear upturn.

- It’s moving towards the higher level of the channel. As a result of this, the momentum is building high.

- 10 Day EMA is higher than the 13 Day EMA and this denotes Uptrend.

- Stock is above the 100 Day SMA. Because of this, lows in the stock is capped.

- When the stock breaks 610, the next leg of a huge upturn unfolds!

- MACD is at 14.13 and Signal at 12.18. As a result, momentum is UP.

- Divergence is at 1.94. As least as possible denoting, continuity in the Up Trending action.

- Fast stochastic and Slow Stochastic is neat to 90. Because of this, a sudden fall is expected.

- Stock is continuously clocking higher highs, denoting a positive trend.

As a result of this technical analysis, great news, we will see a huge leg up unfold in Nesco Limited.

CMP: 578.9

Target in 1 YEAR: 770

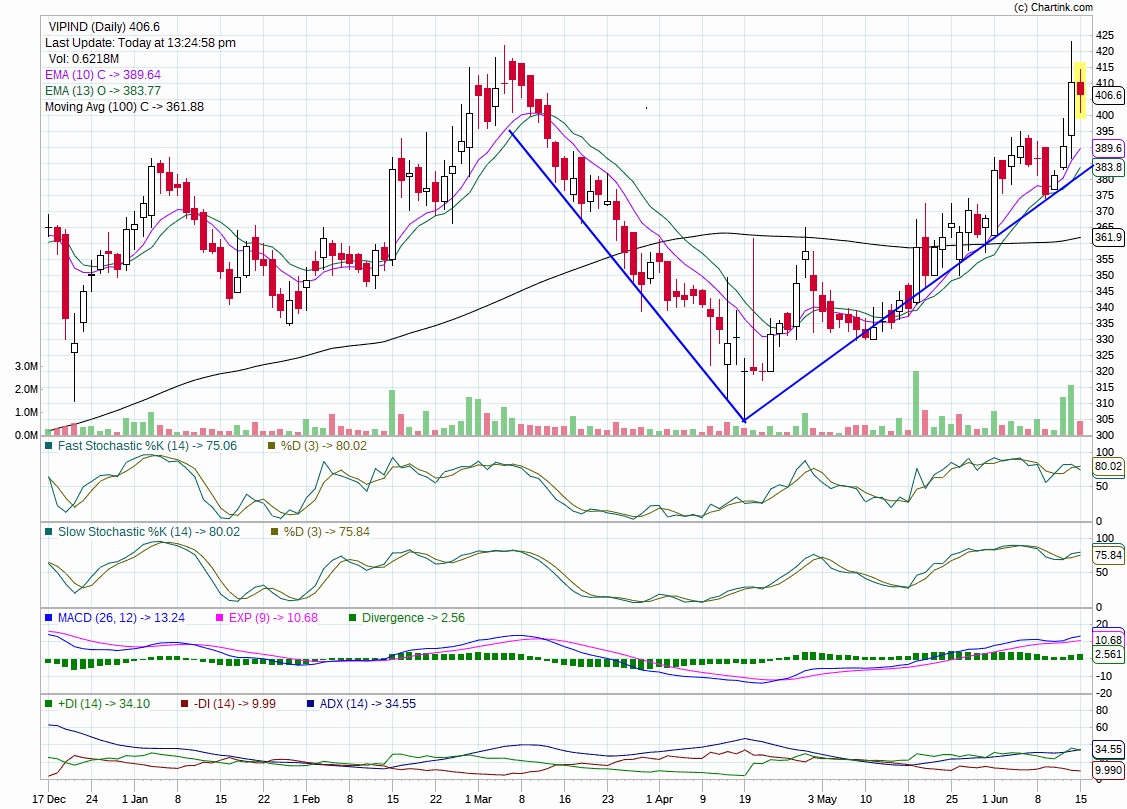

4) VIP Industries (VIPIND)

My 2nd favorite stock pick for best investment ideas for small investors.

Disclaimer: VIP Industries is in my portfolio from 2013.

See when you look for the best ideas for small investments, VIP Industries scores huge in the list.

When I see a potential stock with a great potential for growth, I would not sell it, until it shows negative technicals.

It’s quite fascinating to pick stock ideas for investment in the long term. As a result of this, we have a lot of fun seeing our money grow.

I see strong growth in VIP Industries in long term, and it has quadrupled my investment.

As a result of this, my views of technical analysis prove to be right.

Technical Analysis Points that make VIP Industries Stand Out:

- VIP Industries saw a rounding bottom formation and this makes the stock investable.

- Fast Stochastic is at 75 and slow stochastic is at 80. As a result, we see a continuation of the Up Trend.

- MACD is 13.24 higher than the signal at 10.68 and this denotes a great momentum on the UPPER Side.

- Stock is above 100 Days SMA, denoting a huge support at 100 Day SMA.

- Positive Directional Movement came below 5 and recovered the stock price higher. Because of this technical analysis is well followed.

- 10 Day EMA is higher than 13 day EMA, denoting a huge Positive for the stock.

- It crossed its resistance zone around 381, which shows a huge positive for the stock.

As a result of all the above technical analysis data, I feel, VIP Industries is still a huge hit.

CMP: 400.9

The target for 1 Year in VIPIND: 465

I hope, I’ve made justice for your choosing the right stocks for your investments. I’ve done a huge analysis finding the top stocks for the best investment ideas for small investors.

If you feel, this helped you, please share to all who may get a great benefit for their investments.

Thanks a lot for reading my best investment options for small investors pick for 2021.

I’ll promise to keep this article updated well and keep track of my picks over time.

Follow us on Facebook at Exotic Investment.

Thanks a lot for reading till now.

HAPPY TRADING AND HAPPY MONEY MAKING!