Fibonacci Retracement Vs Extension comparison or differences is what we’ll look at in this blog post.

Having been in the trading field for 15 years now, some indicators are my favorite. A full-time technical analysis trader has a toolkit, which cannot miss Fibonacci retracement.

By the way, I just blogged about SGX Nifty Trend and its influence on Indian markets. Don’t forget to read that.

Fibonacci retracement in itself can be considered as a whole strategy to trade. It can give us support and resistance levels.

Because of this, It can predict the level at which we have to book or profits.

Fibonacci retracement is derived from the all famous Fibonacci. He mentions that there’s a term called as Golden Ratio. Fibonacci derived that it is a part of every ratio.

Like the distance between your fingers. Or like the distance between the tiles laid on the ground.

So without further ado let’s jump in and understand Fibonacci retracement vs extension.

Here’s a Fibonacci retracement youtube video showcasing whatever I’ve spoken below about:

Fibonacci Golden Ratio:

Fibonacci retracement levels are derived from the Fibonacci Golden Ratio.

Fibonacci numbers are created by adding two numbers consistently. Consider 0 and 1 for instance.

Add 0 and 1 we get 1. Add 1 and 1 we get 2.

So the Fibonacci numbers go this way: 0,1,1,2,3,5,8,13,21,34,55,89,etc.

So the Fibonacci retracement levels are derived by dividing consecutive numbers like 0/1=0. 1/1=1, 2/1 = 2, 3/2 = 1.5, etc.

Fibonacci retracement: How to Draw it?

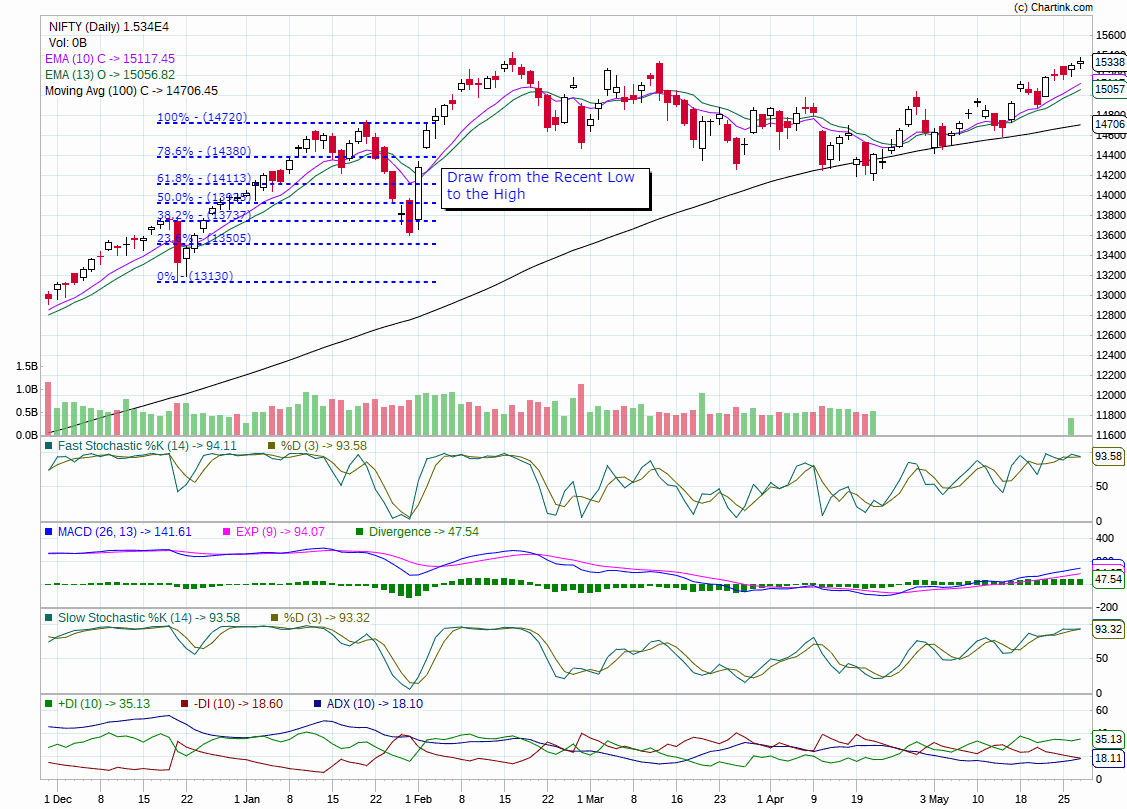

Chart: Chart Ink

Fibonacci retracement is drawn from the recent Lo to the recent highs. It indicates different levels of supports and resistance in between.

Though 100% and 0% are considered as very strong support or resistances, other levels in between are truly considered as support or resistance as well.

50% level of Fibonacci retracement is usually not very considerate in all the trading charts.

Every trading chart has a different way of showing the Fibonacci retracement.

If at all you have to use Nifty trend finder then attachment will play a great role.

Fibonacci Retracement Vs Extension: Which is Better?

- Fibonacci retracement is a retracement chart that shows supports and resistances.

- Fibonacci retracement considers retracement which moves down at least to 78.6 percent as a good retracement.

- Fibonacci Extension predicts the level of target by moving Fibonacci retracement upwards.

- The Fibonacci extension gives a clear picture of target predictions.

- The extension is used by about 70% of the technical analysis camaraderie. So it proves as a very effective tool for profit booking.

Fibonacci Retracement Vs Extension: Disadvantages

- Fibonacci Retracement confines us to find the moment only in between two levels.

- Fibonacci Retracement in itself cannot be a support or resistance level.

- Retracement takes into consideration the Golden Ratio in which the levels keep on increasing. This makes it hard for the retracement to show the exact support or resistance.

- The Fibonacci extension can only provide one level of the target. If the market shuns without reaching the target, you are left nowhere.

Fibonacci Retracement Vs Extension: Comparison

Fibonacci Extention:

Chart: Chart Ink

You can clearly see in the chart that the Fibonacci extension, has given up a clear target to book.

As a result of this, multiple brokerages and Technical analysts book their profits at the same exact level.

As already mentioned, Fibonacci retracement, when moved from 61.8% level to 100% level, we get the Fibonacci extension.

You may see that the Fibonacci extension is accurate enough to protect the target.

Fibonacci Retracement Vs Extension: Benifits

- Fibonacci retracement can predict the level of retracement in an uptrending move.

- Fibonacci retracement acts as support and resistance in between those Golden Ratio levels.

- The Fibonacci extension will exactly predict the level of the target.

- Fibonacci Retracement Vs Extension is widely used in technical analysis camaraderie. So the level of accuracy is about 85%.

- It is very easy to to learn and protect the market with Fibonacci Retracement Vs Extension levels.

Fibonacci retracement youtube Video where I made Money:

In this above Fibonacci retracement youtube video, I have used multiple technical analysis indicators to make my profit.

In the above fibonacci retracement youtube video, I have also used the Fibonacci retracement to book my profit.

So you can see just Fibonacci retracement how much it can be a helpful tool.

Fibonacci Retracement Vs Extension: Closing thoughts

Fibonacci retracement is a very nice tool to predict what happens in the future.

The Fibonacci extension is an extension of Fibonacci retracement which will very nicely predict the future target.

Fibonacci retracement is used by 80% of Technical Analysis camaraderie which makes it the best tool in your arsenal.

Now go out there and use the Fibonacci retracement and comment below your success rate.

In case you need more info about usage and levels of Fibonacci retracement, you’ve to enrol in my 6 Days Live Nifty Options Training, where I teach whole of the levels and how many levels up and down should I book profits.

I have a full module dedicated to the Fibonacci retracement target booking in my Intraday Options Trading Course.

If you found good results do comment below. I am very happy for you if you use fib retracement and it makes money for you.

Don’t forget to share this post with your colleagues and friends who are traders.

Last but not least, together we can stop Corona, not to gather.

Happy trading and happy money-making!