Learn About Stock Market Basics my Super Learners on Exotic Investment from Scratch.

How to learn about stock market basics, is a question to be answered very well, as fundamentals are the cornerstone for success.

This is a No Jargon guide to my Super learns of Exotic Investment to learn the basics of the stock market for absolute beginners.

I’ll simplify many things which you feel are very complicated in the Indian stock market’s context.

Because I am a full-time trader, many ask the same basic question as to what are the steps to learn about stock market basics in India?

Must Read: 11 Things to Learn Before You Want to Know How do I start with stock trading in India?

What are the things covered in Learn About Stock Market Basics Article?

- What are Stock Markets?

- What is a Primary Market and a Secondary Market?

- What are stocks/shares?

- How to trade stocks/How to trade shares?

- What is the way to invest in Primary Market?

- What is the way to trade/invest in a Secondary Market?

- How do people make money with Stock Markets?

- What is technical analysis?

- What is Fundamental analysis?

- Strategies required to trade in stock markets.

1) What are Stock Markets?

Stock markets are the platform of a particular country where, IPOs, ETFs, BONDS, SHARES/STOCKS are traded.

Stock markets have an index for their exchange, which will determine the country’s progress.

Currently, there are two stock exchanges in India which are Bombay Stock Exchange and National Stock Exchange.

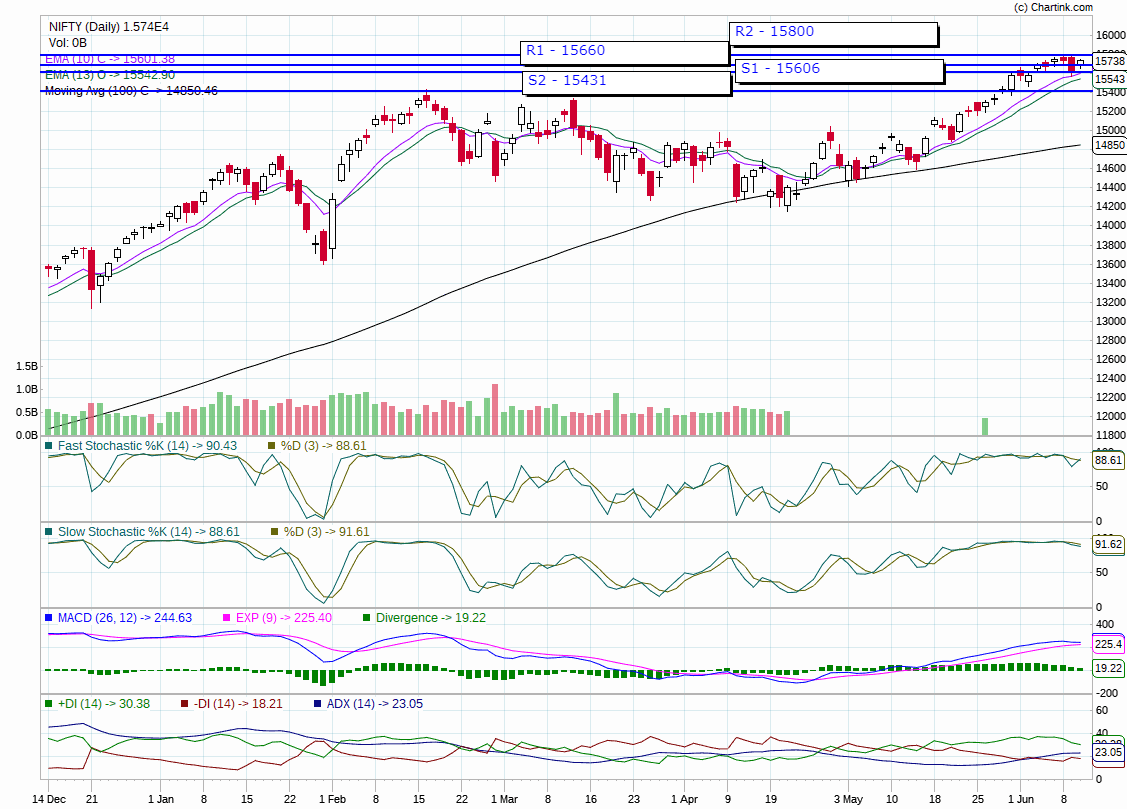

The index of the Bombay Stock Exchange is called Sensex. The index of the National Stock Exchange is called Nifty.

Sensex includes 30 companies and Nifty includes 50 companies.

Definitions

- IPO; Initial Public Offering, meaning, the first time a company offering its shares to investors.

- ETF: Exchange-traded Fund, meaning, Funds from Fund Houses, buying a portfolio of stocks to attain profits.

- Bonds: Fixed income assets to offer a fixed return in return to the money invested.

- SHARES: Shares/Stocks means, its the holding of a company’s share in electronic form.

Stock markets comprise of Primary and Secondary markets, which we’ll discuss in the topic further.

2) What is a Primary Market and a Secondary Market?

Primary Market:

The primary market is a platform for companies to offer their Initial Public Offering (IPO) to new investors.

Why is an IPO required?

IPO is a means for the company to go public and raise money from investors. Its price is set by the company to offer its holding by a percentage through IPOs to be traded in secondary markets.

IPO is a means for the company to gain trust in the investor’s eyes and grow further.

An investor, if he feels, the company is good, invests in IPO and gets the shares in electronic form in his Demat account.

Ex) If you’d invested in 100 shares of the IPO of Infosys in 1993 when Infy went public, you’d have Rs. 2 Crores now!

IPOs can be very powerful. When the giant Alibaba, went public, its IPO price $33, tripled at $94 – $104 on the opening day!

Secondary Market:

A secondary market means it is the platform where traders and investors buy and sell shares and, ETFs.

Each company offers their shares in the form of an IPO. After the IPO is offered, people can only buy and sell the shares of the company in the secondary market.

Can a Common person gain access to the secondary market?

A) Any common person, who is a resident of India, can get a trading account to trade or invest in the secondary market.

What are the secondary markets available for trading?

A) Bombay Stock Exchange and National Stock Exchange are the exchanges where you can trade the shares of Companies.

How can I open a trading account?

A) Before we go any further, read this article, Stock Market Basics for Beginners. You may open a trading account with any of the leading brokers in India.

3) What are stocks/shares?

Stocks mean the share of a business/company which you can own.

How Many Stocks Can a Company Have?

It depends on the market capitalization of the company and the number of shares the company is offering.

Also, it depends on the current price of the shares offered in the IPO. There is no fixed cap on how many shares a company can offer for trading in the secondary market.

Usually, when the company’s book value grows, the share prices go up in value.

4) How to trade stocks/How to trade shares?

Read Now: Options Training Session 1: 5 Option Trading Tips that Stock Market Courses Don’t Ever Teach

Good Read: Options Trading Basics Session 2 – What Are Options? What does Puts and Calls mean in Futures and Options trading in India?

- First, you would need knowledge of technical analysis.

- For technical analysis, you need good charting software.

- Once you understand technical analysis, use a good strategy to trade underlying assets.

- After figuring the trading strategy, you need a trading account with a leading broker in India.

- Then follow Regular Nifty Trend updates to know how to markets would open daily.

- Then trade either in Nifty Options of Nifty Futures.

5) What is the way to invest in Primary Market?

You would require a Trading and Demat Account from a leading broker in India.

A trading account means your front-end account to invest in the stock.

Demat account is the storage account either provided by CDSL or NSDL in India. Demat account is the place where your electronic shares are stored and accounted for.

Once you apply for the IPO through your broker, you are asked to pay a certain amount.

After the payment, you are allotted the IPOs on a first cum first serve basis.

6) What is the way to trade/invest in a Secondary Market?

The same thing that applies to a primary market is applicable for the secondary markets too.

You would require a trading and Demat account to trade in the secondary markets.

Trading Software and charting software are provided by the brokerage firm you open the account with.

7) How do people make money with Stock Markets?

There are 3 ways people make money in stock markets.

- Invest in the Primary market, through IPOs and sell it in secondary markets for a profit. IPO investment, if liquified in an year is taxable.

- Trade-in Secondary market and find the right trend of the stock and make money. Short-term trading gains are taxable.

- Invest for the long term in stock and wait for it to make gains. Long-term investment in shares for more than a year is Tax-free.

8) What is Technical Analysis?

Technical Analysis is the pictorial representation of the past and presents to predict what happens in the future.

It will use the indicators and strategies to predict the movement of the future using what’s happened in the past.

I’ve jotted down lots of indicators and strategies in the blog post of technical analysis.

It involves a lot of technical indicators like:

- Supports

- Resistances

- Fibonacci Retracement and Fibonacci Extention

- Exponential Moving Averages (EMAs)

- Simple Moving Average (SMA)

- Fast Stochastic

- Slow Stochastic

- MACD

- Directional Movement Indicator

Since this is the basics, you may read the article in the link above for understanding technical analysis.

9) What is Fundamental analysis?

Fundamental analysis is the mathematical calculation of the profits and losses of the company and deciding to buy a stock.

Fundamental analysis considers P/E Ratio, which means, Price to Earnings Ratio.

Higher the P/E ratio, overvalued the stocks of the company are.

Calculation of P/E Ratio:

P/E Ratio = Market value of the share/Earnings per share

Fundamental analysis also involves a lot of going through the books(orders) of the company.

How much is the books filled and how profitable the company can be in the future.

More the books are full, more profitable the next quarters can be.

It also involves the debt ratio, to the earnings of the company. The more debt-ridden the company is, the lesser the profits the company makes.

Also there is a calculation of EBITDA which means Earnings Before Interest Taxes Depreciation and Amortization.

The higher the EBITDA, the more the company is growing and the more the value of stocks of the company rises to be.

10) Strategies required to trade in stock markets.

I can give you 2 strategies to make good money trading.

- Nifty Trend Calculator method.

- Bank Nifty Trend Method.

Since this is to learn about stock market basics, I’ve not covered in-depth knowledge of Strategies.

The more you practise, the more you become perfect and hence get profits eventually.

Take the first Leap and open a trading and Demat account.

Then learn and learn, only by learning, you’ll start earning!

Take good care of yourself. I’ll see you in my next article.

Happy Trading and Happy Money Making!